riverside county sales tax calculator

Fast Easy Tax Solutions. The local government cities and districts collect up to 25.

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

How to Calculate California Sales Tax on a Car.

. The average cumulative sales tax rate in Riverside Texas is 825. This includes the sales tax rates on the state county city and special levels. The California state sales tax rate is currently.

The Riverside California sales tax is 875 consisting of 600 California state sales tax and 275 Riverside local sales taxesThe local sales tax consists of a 025 county sales tax a 100 city sales tax and a 150 special district sales tax used to fund transportation districts local attractions etc. California State Sales Tax. The minimum combined 2022 sales tax rate for Riverside County California is.

The local sales tax rate in Riverside County is 025 and the maximum rate including California and city sales taxes is 925 as of August 2022. This is the total of state and county sales tax rates. You can also use Sales Tax calculator at the front page where you can fill in percentages by yourself.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The Riverside County California Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Riverside County California in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Riverside County California. This includes the sales tax rates on the state county city and special levels.

What is the sales tax rate in Riverside County. CDTFA public counters are now open for scheduling of in-person video or phone appointments. Within Riverside there is 1 zip code with the most populous zip code being 77367.

Within Riverside there are around 16 zip codes with the most populous zip code being 92503. Average Local State Sales Tax. Riverside County Sales Tax Rates for 2022.

Of the 725 125 goes to the county government. The average cumulative sales tax rate in Riverside California is 863. The Riverside County Tax Collector offers the option to pay property tax payments online and by automated phone call.

Riverside CA Sales Tax Rate. 775 Alberhill Lake Elsinore. 2020 rates included for use while preparing your income tax deduction.

The Riverside County sales tax rate is. You can use our California Sales Tax Calculator to look up sales tax rates in California by address zip code. Riverside County in California has a tax rate of 775 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Riverside County totaling 025.

Maximum Local Sales Tax. Riverside is located within Walker County Texas. The Riverside County Sales Tax is collected by the merchant on all qualifying.

For questions about filing extensions tax relief. Ad Find Out Sales Tax Rates For Free. Ad Automate Standardize Taxability on Sales and Purchase Transactions.

CA is in Riverside County. Riverside is located within Riverside County California. The sales tax also includes a 50 emissions testing fee.

The average cumulative sales tax rate in Riverside Connecticut is 635. The Tax Collectors Office accepts payment by credit card at a 228 convenience fee and by debit card for a 395 flat fee. Businesses impacted by recent California fires may qualify for extensions tax relief and more.

Within Riverside there is 1 zip code with the most populous zip code being 06878. This includes the sales tax rates on the state county city and special levels. The Riverside Missouri Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Riverside Missouri in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Riverside Missouri.

Please contact the local office nearest you. Maximum Possible Sales Tax. SalesTaxHandbook visitors qualify for a free month by signing up via our partner program here.

The December 2020 total local sales tax rate was also 7750. The minimum is 725. To calculate the sales tax on your vehicle find the total sales tax fee for the city.

And instantly calculate sales taxes in every state. US Sales Tax Rates CA Rates Sales Tax Calculator Sales Tax Table. The Riverside County California sales tax is 775 consisting of 600 California state sales tax and 175 Riverside County local sales taxesThe local sales tax consists of a 025 county sales tax and a 150 special district sales tax used to fund transportation districts local attractions etc.

California has a 6 statewide sales tax rate but also has 469 local tax jurisdictions. This rate includes any state county city and local sales taxes. 2020 rates included for use while preparing your income tax deduction.

The latest sales tax rate for Desert Center CA. The current total local sales tax rate in Riverside CA is 8750. US Sales Tax Rates CA Rates Sales Tax Calculator Sales Tax Table.

You can see the total tax percentages of localities in the buttons. The Riverside Sales Tax is collected by the merchant on all qualifying. The sales tax rate does not vary based on zip code.

The December 2020 total local sales tax rate was. Choose city or other locality from Riverside below for local Sales Tax calculation. Desert Center is in the following zip codes.

The sales tax rate does not vary based on zip code. Ad Find Sales Tax Per Zip Code. You can find more tax rates and allowances for Riverside County and California in the 2022 California Tax Tables.

Riverside is located within Fairfield County Connecticut. The 2018 United States Supreme Court decision in South Dakota v. Just enter the five-digit zip code of the location.

The current total local sales tax rate in Riverside County CA is 7750. Please visit our State of Emergency Tax Relief page for additional information. Sales Tax Calculator Sales.

The base sales tax in California is 725. Integrate Vertex seamlessly to the systems you already use. As far as sales tax goes the zip code.

This rate includes any state county city and local sales taxes.

Greater Dayton Communities Tax Comparison Information

Understanding California S Property Taxes

Transfer Tax In Riverside County California Who Pays What

How To Calculate Cannabis Taxes At Your Dispensary

Understanding California S Property Taxes

Understanding California S Property Taxes

Riverside County Ca Property Tax Calculator Smartasset

Food And Sales Tax 2020 In California Heather

Understanding California S Property Taxes

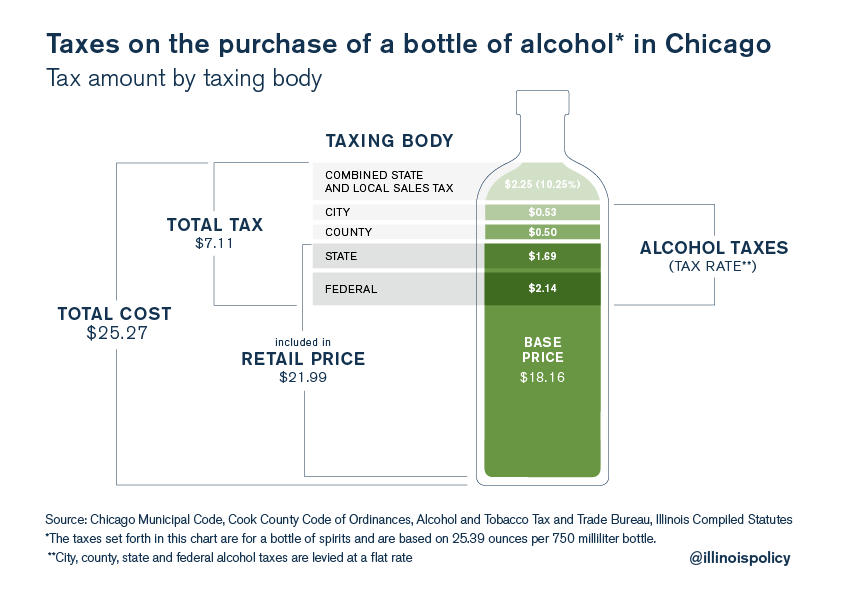

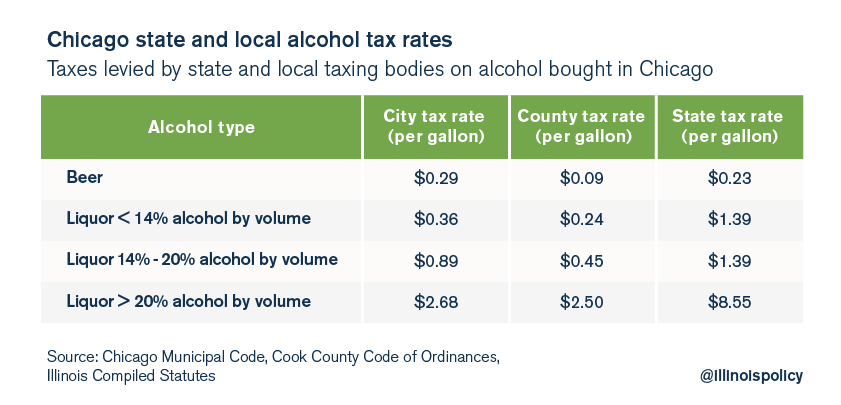

Chicago S Total Effective Tax Rate On Liquor Is 28

California Sales Tax Rates By City County 2022

California Sales Tax Small Business Guide Truic

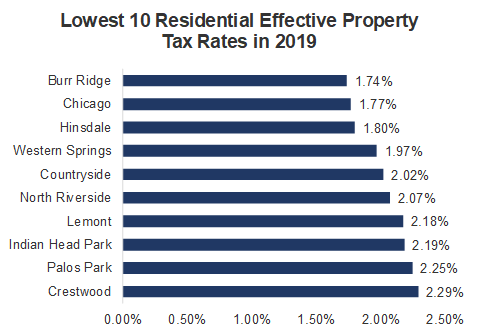

Dupage County Residents Pay Some Of The Nation S Highest Property Tax Rates

Riverside County Ca Property Tax Calculator Smartasset

La County S Sales Tax Increases Sunday To Help The Homeless Here S How Much Daily News

Understanding California S Sales Tax